2024 Mileage Deduction Rate Calculator

2024 Mileage Deduction Rate Calculator. — use mileagewise's free mileage reimbursement calculator for 2024 to get the figure you are entitled to in mileage tax deduction. So for simple math, if your agi is $100,000 for the.

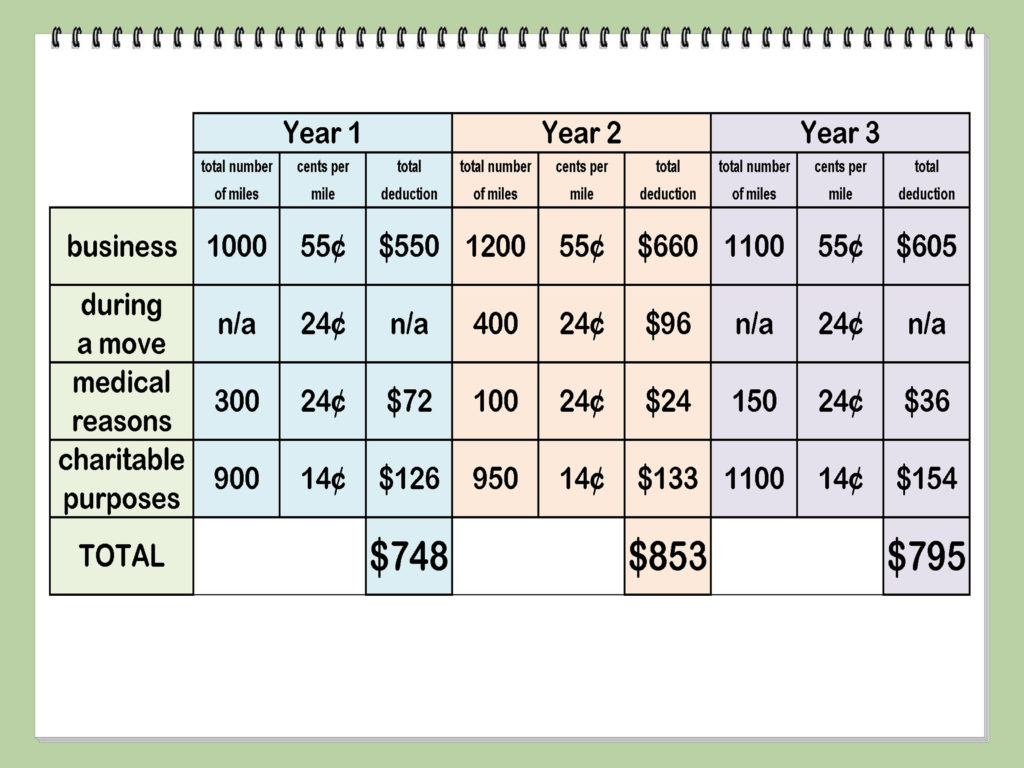

Our calculator uses the latest irs mileage rates to estimate your reimbursement based on the miles you’ve driven and the purpose of the drive (business, medical/moving, or charitable). You have options for deducting business miles on your tax.

2024 Mileage Deduction Rate Calculator Images References :

Source: annieycaroline.pages.dev

Source: annieycaroline.pages.dev

2024 Mileage Rate Calculator Aggie Arielle, This amount is calculated as a baseline or minimum by irs.

Source: claudesherry.pages.dev

Source: claudesherry.pages.dev

Irs Mileage Deduction 2024 Kellia, — how to calculate mileage deductions on your tax return.

Source: dellqtiertza.pages.dev

Source: dellqtiertza.pages.dev

Irs Standard Mileage Rate 2024 Deduction Jenny Lorinda, 67 cents per mile driven for business use, an increase of 1.5 cents from 2023.

Source: abagaelwdanell.pages.dev

Source: abagaelwdanell.pages.dev

2024 Mileage Reimbursement Rate Calculator Download Anni Malena, Our mileage reimbursement calculator helps to determine the compensation of travel while you are on official business.

Source: miquelawfarah.pages.dev

Source: miquelawfarah.pages.dev

Irs Mileage Rate 2024 Calculator Chere Myrtice, — for 2024, the standard mileage rate is 67 cents per business mile for 2024 (up from 65.5 cents for 2023).

Source: dorisaqmelonie.pages.dev

Source: dorisaqmelonie.pages.dev

Mileage Reimbursement Calculator 2024 Patty Bernelle, Use our free 2024 mileage reimbursement calculator to claim back your business mile expenses.

Source: ivymarice.pages.dev

Source: ivymarice.pages.dev

Cra Mileage Rate 2024 Calculator Shina Dorolisa, This amount is calculated as a baseline or minimum by irs.

Source: essybphaedra.pages.dev

Source: essybphaedra.pages.dev

2024 Mileage Reimbursement Rate Calculator Liesa Krissy, — aug 28, 2024 | easily calculate your mileage allowance in the uk with our mileage claim calculator.

Source: leslibloutitia.pages.dev

Source: leslibloutitia.pages.dev

2024 Mileage Deduction Rate Chart Patti Berenice, As of 2024, the mileage rate is now 67 cents per mile.

Source: bkpweb.com

Source: bkpweb.com

The IRS has released the standard mileage rates for 2024., If your medical and dental expenses exceed more than 7.5% of adjusted gross income (agi), you can deduct the overage.

Posted in 2024